Where capital becomes

liquid intelligence.

Nautilus is an AI-native firm building the intelligence layer of cutting-edge markets.

Why Nautilus

We transform hedge fund-grade strategies into composable financial primitives—bringing institutional alpha to the agentic economy.

the agentic economy. fund managers. professional traders. treasury companies. decentralized AI. the agentic economyPerformance

The future of autonomous trading.

Nautilus captures cross-asset signals to drive self-hedging alpha and asymmetric returns.

Return Since Inception

+0.00%

Sharpe Ratio (BTC/ETH/SOL)

0.00

Avg. Weighted Win Rate

+0.00%

Our Core Offering

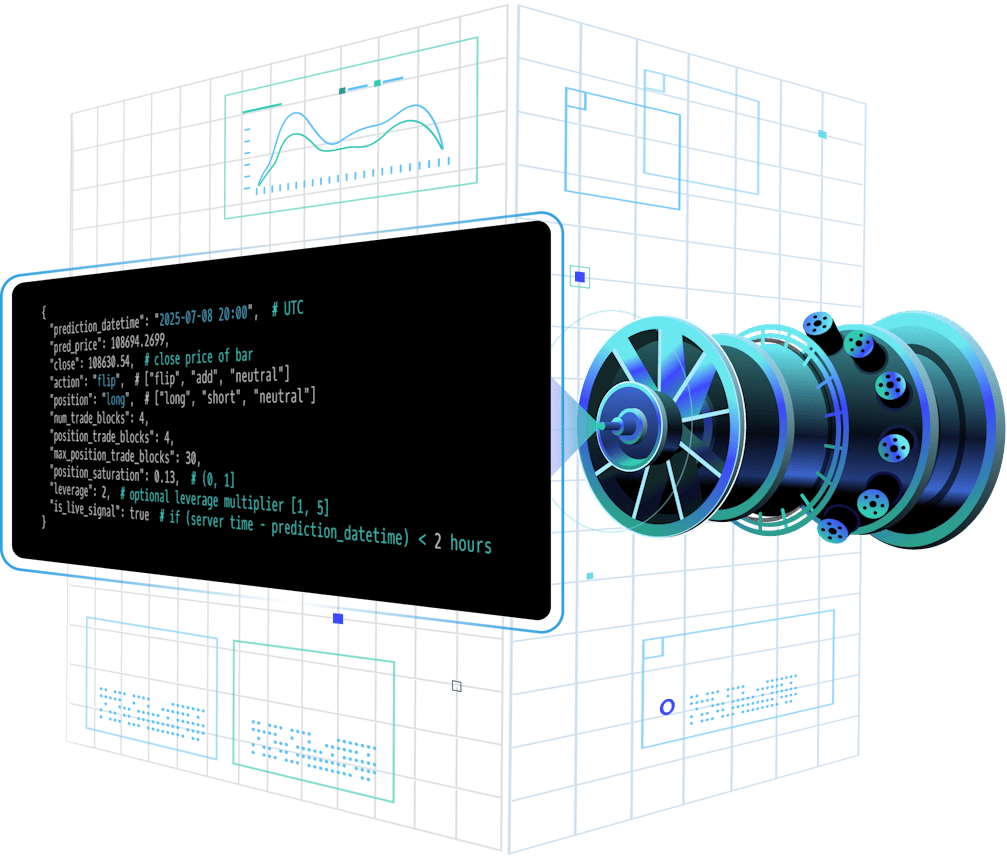

Introducing Seneca

The Intelligence

Engine of Markets

[ INTELLIGENCE ENGINE OF MARKETS ]

Unlike static or single-strategy systems, Seneca continuously adapts across assets, conditions, and time horizons.

Benefits

Transformer-Native

Institutional Deep Learning

[ TRANSFORMER-NATIVE ]

Seneca interprets market data the way an LLM interprets language—learning context, coherence, and timing to predict what comes next.

Primed for Developers

Integrate Seneca’s Intelligence Engine of Markets.

Power your ecosystem with hedge-fund grade intelligence. Seamlessly deploy Seneca’s trading strategies through the Nautilus API, MCP server, or smart contracts. Our solutions are tailored for funds, traders, and treasury companies.

The Next Generation of Quant Trading.

Capture cross-asset signals and execute automated crypto strategies designed for asymmetric upside.

Seneca Prime Bitcoin

Bitcoin Long-Short AI Quant Strategy

Generate self-hedging alpha for asymmetric returns, isolating pure yield from Bitcoin’s volatility.

RETURN

+0.00%

SHARPE

RATIO

0.00

ALPHA

+0.00%

Seneca Prime Ethereum

Ethereum Long-Short AI Quant Strategy

Generate self-hedging alpha for asymmetric returns, isolating pure yield from Ethereum’s volatility.

RETURN

+0.00%

SHARPE

RATIO

0.00

ALPHA

+0.00%

Seneca Prime Solana

Solana Long-Short AI Quant Strategy

Generate self-hedging alpha for asymmetric returns, isolating pure yield from Solana’s volatility.

RETURN

+0.00%

SHARPE

RATIO

0.00

ALPHA

+0.00%

Seneca Prime XRP

Ripple Long-Short AI Quant Strategy

Generate self-hedging alpha for asymmetric returns, isolating pure yield from XRP's volatility.

RETURN

-0.00%

SHARPE

RATIO

-0.00

ALPHA

+0.00%

Seneca Prime ICP

Internet Computer Long-Short AI Quant Strategy

Generate self-hedging alpha for asymmetric returns, isolating pure yield from ICP's volatility.

RETURN

+0.00%

SHARPE

RATIO

0.00

ALPHA

+0.00%

Seneca Prime Composite

Composite Long-Short AI Quant Strategy

Generate self-hedging alpha for asymmetric returns, isolating pure yield from three of the world’s largest market cap digital assets.

RETURN

+0.00%

SHARPE

RATIO

0.00

ALPHA

+0.00%

Our Products

Quant-Driven Institutional Alpha.

Strategy generating AI that navigates your stack via MCP and APIs.

Open-source vaults with verifiable contracts.

Powering professional traders and exchanges.

Scaled for premier digital asset treasury companies.

Supercharging capabilities with frictionless interfaces.

Build with Us

Turn our Signals into your alpha.

Deploy real-time signals and yield strategies engineered by crypto veterans. Access resilient, high-performance trading designed to outperform in both bull and bear markets.

Join Trident

Nautilus delivers institutional alpha through hedge fund-grade, composable primitives. Via Trident, we partner with premier digital asset leaders to accelerate the transition to AI-driven markets.

Join Market Forum

We bridge the gap between AI and quantitative trading to define the next frontier of digital assets. Join the Nautilus network: contribute analyses, run experiments, and earn recognition as we architect the future of finance.

Read the Docs

Leverage our institutional-grade market engine through simple, developer-first documentation. Whether via API, MCP server, or direct smart contract integration, you can deploy sophisticated quantitative strategies into your ecosystem with ease.